| Author |

Topic Topic  |

|

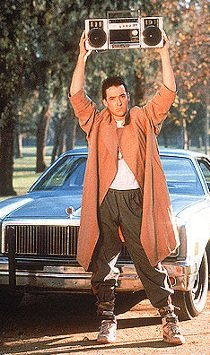

MisterBadIdea

"PLZ GET MILK, KTHXBYE"

|

Posted - 09/29/2008 : 13:46:38 Posted - 09/29/2008 : 13:46:38

|

| For what it's worth, I read on MSNBC just now that there were protests on Wall Street over the weekend, and everywhere in the news there's stories on how absolutely no one seems to like the bailout plan. Indeed, I haven't read a single positive word about it; the lefties are whining all this money is being given as handouts to Big Business, and the righties seem to have suddenly remembered that they're supposed to be for small government. |

Edited by - MisterBadIdea on 09/29/2008 13:55:08 |

|

|

|

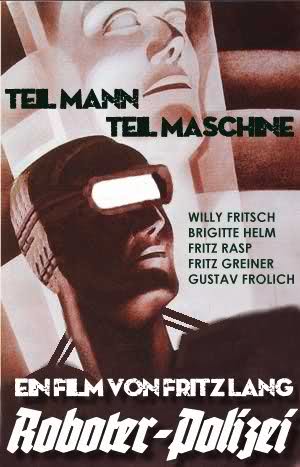

Airbolt

"teil mann, teil maschine"

|

Posted - 09/29/2008 : 13:58:41 Posted - 09/29/2008 : 13:58:41

|

| If you walk into a bank with a gun you get ten years. If you run a Bank into Bankruptcy you get an "oh well" from the Government. There is absolutely no personal liability for Bankers. In fact they often walk away with a Bonus. |

|

|

|

rockfsh

"Laugh, Love, Cheer"

|

Posted - 09/30/2008 : 03:24:06 Posted - 09/30/2008 : 03:24:06

|

| The bailout failed in the House because of the huge public outcry against it. |

|

|

|

Montgomery

"F**k!"

|

Posted - 09/30/2008 : 19:06:34 Posted - 09/30/2008 : 19:06:34

|

quote:

Originally posted by rockfsh

The bailout failed in the House because of the huge public outcry against it.

I guess the American voters have a pulse afterall. And a few brainwaves left, too.

EM :) |

|

|

|

Wheelz

"FWFR%u2019ing like it%u2019s 1999"

|

Posted - 09/30/2008 : 19:51:55 Posted - 09/30/2008 : 19:51:55

|

This editorial in the Chicago Tribune seems to suggest that:

-- The American Public is too stupid to realize that W is only looking out for our best interest, and

-- Congress is bowing to the Public's misguided protests because they're all too afraid of losing in the upcoming elections.

This paints nobody in a favorable light except perhaps our beloved President and, I guess, the Tribune's editorial board for being smarter than all the rest of us.

While I concede that I'm not smart enough to know how to solve this mess, I do know that it's Republican hands-off policies that got us into it. And if they plan to use MY tax dollars to fix things, they'd better damn well get it right.

I also know that after watching my IRA balance shrink for at least the last 4 quarters, I've finally decided the convert the entire balance to cash funds for the foreseeable future. Is that helping Wall Street? Of course not. But I have to protect my own tiny little piece of the pie. Give me one-tenth of the average bank CEO's golden parachute and I'll put it back into the market, I promise. |

Edited by - Wheelz on 09/30/2008 20:13:51 |

|

|

|

BiggerBoat

"Pass me the harpoon"

|

Posted - 09/30/2008 : 21:54:08 Posted - 09/30/2008 : 21:54:08

|

quote:

Originally posted by Wheelz

Give me one-tenth of the average bank CEO's golden parachute and I'll put it back into the market, I promise.

I did read somewhere that if the 400 richest Americans gave half their wealth over, it would match the $700 billion needed. Surely that would be the patriotic thing to do?

Can someone explain to me what went on with the vote by the house of representatives? I saw the Nancy Pelosi speech, followed by the result, after which there was Republican uproar at her words (despite the way they actually voted), finished off by Nancy back on the stand saying that they'd all been convinced by an impassioned President. What are they doing? what does this mean? |

Edited by - BiggerBoat on 10/01/2008 00:46:26 |

|

|

|

silly

"That rabbit's DYNAMITE."

|

Posted - 09/30/2008 : 21:57:09 Posted - 09/30/2008 : 21:57:09

|

Y'all are behind, we aren't even supposed to call it a bailout anymore (Katie Couric warning).

"Billions for Bankers" looks better on the t-shirt, anyways.

For me, personally, I'm just glad the FDIC still insures the $12.58 I have in savings. I might need it to buy a gallon of gas soon. |

Edited by - silly on 09/30/2008 22:41:13 |

|

|

|

BiggerBoat

"Pass me the harpoon"

|

Posted - 10/21/2008 : 21:03:05 Posted - 10/21/2008 : 21:03:05

|

| Looks like the bankers have learnt their lesson and stopped rewarding themselves for ruining the economy. As if. |

|

|

|

randall

"I like to watch."

|

Posted - 10/23/2008 : 22:24:29 Posted - 10/23/2008 : 22:24:29

|

OK, then why aren't Brits storming The City too?

Hey, I've been sitting on my hands until now. Turns out your Masters of the Universe as well have been tangoing with the same HAL-9000/Bozo the Clown derivatives. [Um, Iceland??!?!?!? That's something even we hadn't thought about!] Gluttons on at least four continents got us into this mess. They weren't all in America. Not even most. This is a worldwide problem and can only be solved by people who understand that.

If the UK's judgment is intrinsically better than ours, then how do you explain Tony Blair's complicity in Iraq? [No fair, he's not the citizenry? Well, so it is with us!!!] Nobody has a lock on wisdom: not you, not us. (1) thought-based viscosity is not limited to America; and (2) nobody's leaders necessarily spew the views of the general citizenship, they just try to represent them. Or, in the cases of both Bush and Blair, it may be debatable. |

|

|

|

Sean

"Necrosphenisciform anthropophagist."

|

Posted - 10/24/2008 : 01:08:39 Posted - 10/24/2008 : 01:08:39

|

To be fair, this thread was started a month ago when the global nature of this problem wasn't so apparent. It is absolutely clear now that it's a global problem requiring a global solution.

I think nothing less than a major ideological change in the way the world runs it's financial sector is required. The 'wisdom' of the last few decades is going to have to go out the window. Positions such as "The market always knows best", "Markets are efficient", "Finance works best when self-regulated [read 'un-regulated']" have been proven wrong in spectacular fashion.

The thing that worries me most is that those charged with solving this problem have on the whole clung to market-liberalist ideology in dogmatic fashion for most of their lives. The last thing they'll want to do is to throw their ideology out the window and start again, but I don't think they have any choice at all.

Financial institutions don't trust each other to remain solvent (for very valid reasons obviously), and the only way to get confidence back is to prove to everyone that The System has changed sufficiently that this crisis cannot possibly re-occur. The clear way to do this (well, it's clear to me!  ) is to prohibit precisely the kind of behaviour that got the world into this mess. Clearly this means substantially increased regulation and financial-sector oversight. It may also mean prohibition of excessively predatory behaviour and potentially destructive speculation. ) is to prohibit precisely the kind of behaviour that got the world into this mess. Clearly this means substantially increased regulation and financial-sector oversight. It may also mean prohibition of excessively predatory behaviour and potentially destructive speculation.

Anyway, my guess is that some changes might include:-

- Third-party oversight of mortgage lending.

Where a mortage is clearly not in the interest of the borrower or the lender then it's disallowed. Previously the onus was on the lender to ensure the deal was a sensible one, but lenders are now so detached from borrowers that they can no longer be trusted to be sensible.

- Regulation and control of ALL derivatives.

- Limit the exposure of financial institutions to derivatives thereby preventing greed-induced self-destruction. (Not dissimilar to the way margin-lenders limit absolute exposure of traders to their markets.)

- Control the nature of traded derivatives. Prevent financial institutions from writing any contract they like with whoever they like for whatever value they like whenever they like and thereby gambling with their (and our) futures.

- Create exchanges for derivatives to ensure sensible valuation and public oversight.

None of this should interfere with the sensible flow of capital into industry.

The USSR found themselves in a similar position in the late 1980's; they were faced with clear proof that their 'system' was not a good one and some major change was needed. Having said that, I don't think the changes that the capitalist world needs (in order to be up and running again) are quite as dramatic as what the Kremlin faced. |

|

|

|

BiggerBoat

"Pass me the harpoon"

|

Posted - 10/24/2008 : 12:17:55 Posted - 10/24/2008 : 12:17:55

|

quote:

Originally posted by Randall

OK, then why aren't Brits storming The City too?

Hey, I've been sitting on my hands until now. Turns out your Masters of the Universe as well have been tangoing with the same HAL-9000/Bozo the Clown derivatives. [Um, Iceland??!?!?!? That's something even we hadn't thought about!] Gluttons on at least four continents got us into this mess. They weren't all in America. Not even most. This is a worldwide problem and can only be solved by people who understand that.

If the UK's judgment is intrinsically better than ours, then how do you explain Tony Blair's complicity in Iraq? [No fair, he's not the citizenry? Well, so it is with us!!!] Nobody has a lock on wisdom: not you, not us. (1) thought-based viscosity is not limited to America; and (2) nobody's leaders necessarily spew the views of the general citizenship, they just try to represent them. Or, in the cases of both Bush and Blair, it may be debatable.

Don�t get me wrong Randall, our guys are equally complicit � I�m not ranting at Americans but greedy fuckers (and the administrations that allow them to be) the world over. I haven�t been storming the financial district as such but I have been down there stirring. Have almost been in several fights after I�ve told various members of the banking industry quite what I think of them. Some friends and I have been going down to deliberately goad them. Some of the best lines have included:

�Hey, can I get that drink for you? Oh, wait, I probably already have.�

�Bankers� consciences are like cheques � they only take a few days to clear.�

�If you�re considering suicide, think of those you leave behind. Surely there are some other bankers you could take with you?�

My flatmate is a stand-up comedian and he has a regular gig in the city (about two minutes from the flat where Tom Cruise holed up in Mission Impossible) so we�ve been writing some good lines. He picked on one guy who was there with a stunning wife who was dripping in jewellery. He said, �You do realise that now the money�s gone you�re just a fat, ugly man with a beautiful wife.� Which got that classic �Ouch, that hurts� laughter from the crowd. He followed it up with, �No, no, I�m sure you�re great in bed and keep her intellectually stimulated .� The guy didn�t laugh but she let out a nervous giggle. �I don�t know what you�re laughing at darling, half of nothing is nothing you know.� They both left at the next break.

I�ve been pretty busy on other forums laying into our bankers but because of our transatlantic connections here I want to find out what you American chappies feel about it all. Personally I�m delighted. Yes there�s going to be a lot of hardship, but actually, that�s what life is like for 90% of the planet�s population. If the pinnacle of human achievement is a group of countries whose populations are fat, stupid and consume without any thought of consequence then maybe this is exactly what we needed.

�Who is the bigger criminal: he who robs a bank or he who founds one?� � Berthold Brecht

|

|

|

|

Sean

"Necrosphenisciform anthropophagist."

|

Posted - 10/25/2008 : 03:10:45 Posted - 10/25/2008 : 03:10:45

|

quote:

Originally posted by BiggerBoat

..... maybe this is exactly what we needed.

I don't think this crisis is going to change much though (other than how I outlined in my earlier post). I don't think there's going to be any significant bridging of the rich/poor gap, or reduction in consumption (although perhaps in the short-medium term there'll be a reduction due to the unwinding of debt and fear about the future).

The meek are always going to be fed upon by the predators as they share the trait of greed, but lack the other traits required to become predators themselves. In a nutshell:-

Prey: greedy, ignorant*, lazy, gullible.

Predators: greedy, knowledgeable*, hard-working, discerning. And ruthless.

*However, over the last 10-20 years almost all have become "ignorant" with respect to finance as it's become so complicated that few can understand it - hence this crisis.

I think all the masses really want is for this whole nasty crisis to go away so they can feel safe buying more stuff. |

|

|

|

randall

"I like to watch."

|

Posted - 10/25/2008 : 20:26:41 Posted - 10/25/2008 : 20:26:41

|

Not to pile on any more Americans [because the folks in this thread have demonstrated with their words that they understand clearly that this problem is global], but I think back to what Dubya said shortly after the War on Terror began: what we needed to do to support our country was to shop.

As my page-a-day calendar proclaims: 87 days. |

|

|

|

Sean

"Necrosphenisciform anthropophagist."

|

Posted - 10/25/2008 : 22:35:03 Posted - 10/25/2008 : 22:35:03

|

Wouldn't it be nice if we could all consume our way out of every problem? |

|

|

|

lemmycaution

"Long mired in film"

|

Posted - 10/26/2008 : 02:38:31 Posted - 10/26/2008 : 02:38:31

|

quote:

Originally posted by Randall

Not to pile on any more Americans [because the folks in this thread have demonstrated with their words that they understand clearly that this problem is global], but I think back to what Dubya said shortly after the War on Terror began: what we needed to do to support our country was to shop.

As my page-a-day calendar proclaims: 87 days.

Grasshopper, Sensei is in countdown mode with you. |

|

|

Topic Topic  |

|